Coinbits Review

Are you considering investing in cryptocurrency? If so, it’s important to know the risks of digital currency platforms like Coinbits. As investors continue to flock to cryptocurrency as a potential investment opportunity, it is becoming increasingly important for them to understand the potential risks associated with such platforms. This blog post by Report Scam Community serves as a warning about the fraudulent practices of Coinbits – from forging documents and lying about its financial status – and provides solutions for investors to protect themselves from such practices. By understanding these risks, investors can make better and more informed decisions when deciding whether or not to invest in Coinbits. Read on to learn more about this digital platform and how you can protect yourself from being scammed.

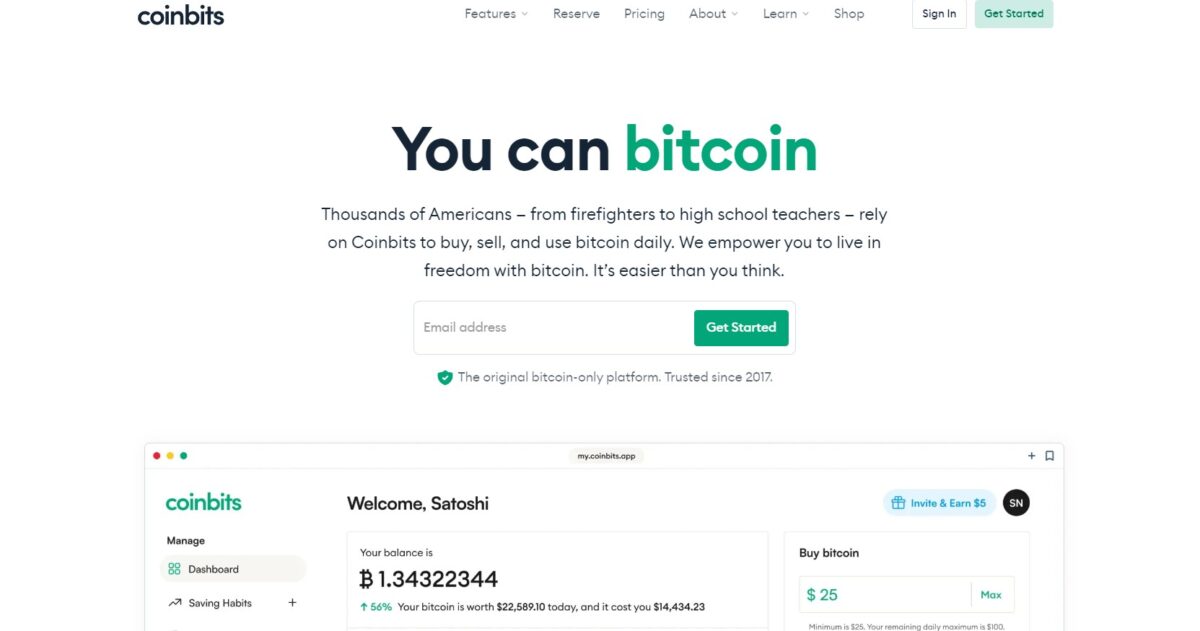

What is Coinbits?

Coinbits is a digital currency platform that is becoming increasingly popular with investors looking to diversify their portfolios. Launched in 2017, Coinbits provides users with a secure and user-friendly platform to buy, sell, and transfer digital currencies. Coinbits supports multiple cryptocurrencies such as Bitcoin, Ethereum, Litecoin and Dash, and offers a variety of features and tools to help users manage their investments. Currently available in over 100 countries around the world, Coinbits was created with the aim of creating an accessible yet secure way for people to trade digital currency.

Coinbits makes it easy for users to access the cryptocurrency market by providing an intuitive interface that allows for quick navigation through different sections of the platform. With its comprehensive suite of features and tools, Coinbits gives users complete control over their investments – from tracking real-time prices movements to setting up automated trading strategies – all within one platform. Furthermore, Coinbits also provides educational resources such as tutorials and webinars designed to help users make informed decisions when trading digital currency.

Given its ease-of-use and wealth of features, it’s no surprise that more investors are turning to Coinbits as an alternative investment option. However, it’s important for investors to understand the potential risks associated with this type of platform before investing their money. This blog post serves as a warning about fraudulent practices like forging documents and lying about financial status on platforms such as Coinbits – and provides solutions for investors looking to protect themselves from potential scams.

The Risks of Investing in Coinbits

Investing in Coinbits presents a variety of risks that investors should be aware of. Coinbits is a relatively new investment platform, and therefore may not be as heavily regulated as traditional investments. This could lead to issues such as fraud or mismanagement, which could cause investors to lose their money.

Storing funds on the Coinbits platform also poses a risk since there are no safety guarantees in place for users’ funds, leaving them vulnerable to theft or loss if the platform experiences technical issues or outages. Additionally, since there is no consumer protection offered by Coinbits, disputes between users cannot be resolved through official channels; this leaves investors open to potential fraud and scams.

Finally, due to its decentralized nature, it can be difficult for investors to keep track of their investments on the Coinbits platform. This can leave them open to manipulation from malicious actors and hackers who may seek to exploit weaknesses in the system for their own gain.

By understanding the risks associated with investing in Coinbits, investors can make more informed decisions about their investments and protect themselves from potential losses caused by fraudulent activity or mismanagement.

The Legality of Coinbits and Warnings from Government Agencies

Investing in digital assets like Coinbits can be a lucrative opportunity, but it is important to ensure that any such investments are legal and compliant with all relevant regulations and guidelines. Potential investors should take the time to research the legal status of their desired investment before proceeding and exercise caution when considering any kind of investment opportunity. By doing so, they can reduce the risk associated with investing in digital assets and protect themselves from potential losses due to fraudulent activity or mismanagement.

Examples of Fraudulent Practices by Coinbits

Coinbits has been exposed for a number of fraudulent practices, from fabricating documents to mask access to investor funds, misrepresenting its financial status and manipulating stock prices. These deceptions can be highly damaging if left unchecked.

The company has been known to forge contracts and other financial records in order to gain unauthorized access to investors’ resources. Likewise, it could also be lying about its financial standing in order to lure more investments or alter stock prices with the aim of boosting gains.

Insider trading is another common deceptive practice employed by Coinbits. This involves taking advantage of material nonpublic information that can give the firm an edge over rivals or harm other investors. Furthermore, they have also been observed using aggressive tactics like coercion in order to pressure potential buyers into purchasing their coins on the promise of huge payouts.

Investors should always remain vigilant when it comes to investing in any digital currency such as Coinbits and do their due diligence beforehand. They should take proactive measures so as not to become victims of fraud or mismanagement resulting in losses.

Solutions for Investors to Protect Themselves from Fraudulent Practices

Investing in digital currencies can be a tricky business, especially with the emergence of platforms like Coinbits. The best way for investors to protect themselves is by taking the time to do their due diligence and research before committing funds. This includes verifying any claims made by operators of cryptocurrencies, such as Coinbits, and ensuring that their currency is stored safely in a secure wallet with two-factor authentication.

When it comes to Initial Coin Offerings (ICOs) and Security Token Offerings (STOs), which are not regulated by the SEC or other government agencies, investors should always conduct a thorough evaluation of potential investments prior to committing funds. Consulting with a financial advisor or enlisting the help of an experienced third-party specialist may also be beneficial when researching digital currency investments, particularly those that could have significant value.

It’s important for investors to remember that there are risks associated with any kind of investment opportunity, including those involving cryptocurrency platforms like Coinbits. Investors should never invest more than they can afford to lose and stay vigilant when monitoring their investments on a regular basis so any discrepancies can be identified quickly and action taken if needed. By following these steps and remaining aware of their investment decisions at all times, investors will be better equipped to avoid fraudulent practices associated with digital currencies like Coinbits and make sound decisions regarding them.

If you are scammed by Coinbits, you should contact Report Scam for helping in fund recovery.

Visit our Twitter Page.

Read BitTrust